Fast Delivery

Multiple courier options

Rs.361

Rs. 425

15% OFF

Inclusive all taxes

This Product is out of stock

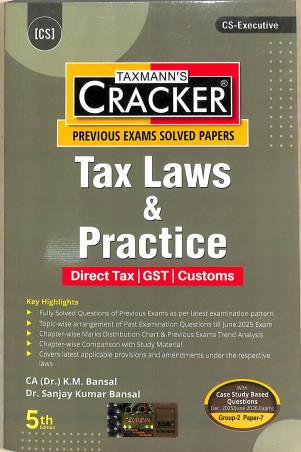

Tax Laws & Practice ? Direct Tax | GST | Customs | CRACKER is a comprehensive and examination-focused resource meticulously designed for CS-Executive aspirants under the New Syllabus. This book serves as an indispensable revision tool by integrating fully solved previous exam questions, case study-based multiple-choice questions (MCQs), updated amendments, and analytical tools, such as chapter-wise mark distribution and trend analysis. The Present Publication is the 5th Edition for the Dec. 2025/June 2026 Exams. This book is authored by CA. (Dr) K.M. Bansal & Dr Sanjay Kumar Bansal, with the following noteworthy features: [Fully Solved Questions from Previous Exams] This book incorporates comprehensively solved questions from past CS-Executive examinations, including those held up to June 2025. Each answer is drafted in accordance with the latest ICSI examination pattern, ensuring students are well-versed with current question trends and expected answering standards [Topic-wise Arrangement of Questions] The questions have been meticulously organised chapter-wise and topic-wise to align with the prescribed syllabus and logical flow of concepts. This structure enables students to practice and revise systematically, building clarity on each specific area of Direct Tax, GST, and Customs Law [Case Study-based Objective Questions] Special emphasis is placed on case-based multiple-choice questions (MCQs), which reflect the current pattern adopted by ICSI for testing practical understanding and analytical thinking. These questions help students prepare for scenario-based evaluations and improve application skills [Chapter-wise Marks Distribution] Includes an analytical chapter-wise marks chart for exams from Dec. 2023 to June 2025, which offers insights into the weightage of each chapter. This aids in prioritising preparation based on high-scoring areas and historical exam trends

| Author | K. M. Bansal, Sanjay Kumar Bansal |

| Publisher | Taxmann Publications Pvt. Ltd. |

| Language | English |

| Binding Type | Paper Back |

| Main Category | Commerce & Business |

| Sub Category | Law & Taxation |

| ISBN13 | 9789364558464 |

| SKU | BK 0204794 |

Rs. 300

Rs. 255

15% OFF

Rs. 280

Rs. 238

15% OFF

Multiple courier options

Within 15 Days

100% Secure Payment

Within 1 Business Day